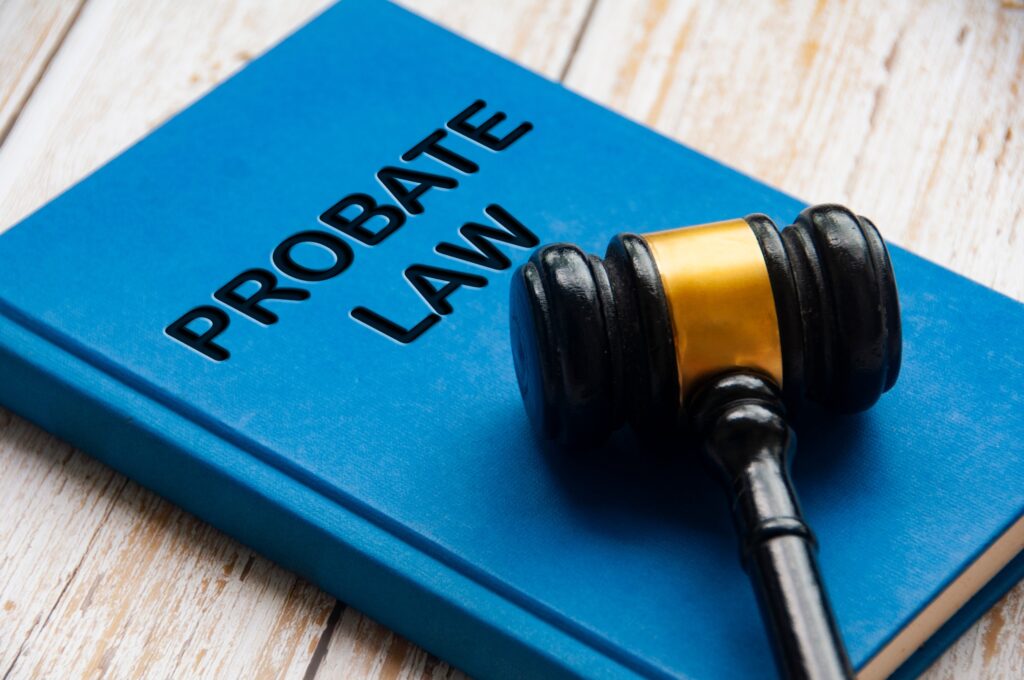

Common law marriage impacts inheritance in several different ways. In an Oklahoma probate case, whether a surviving partner is legally recognized as a spouse can determine who inherits property, who has priority to administer the estate, and whether certain statutory protections apply. Because Oklahoma recognizes common law marriage under specific circumstances, disputes frequently arise after death—particularly when there is no…

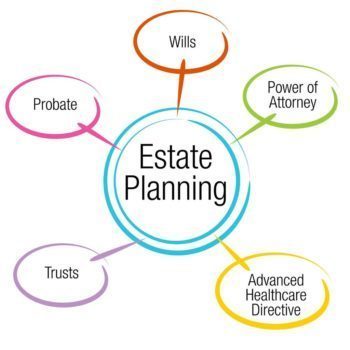

Explaining The Way that Common Law Marriage Impacts Inheritance in Oklahoma