Asset Protection in Oklahoma Estate Planning is not that difficult. Imagine the feeling of having your entire life savings vanish at the hands of your creditors or judgement holders. You might own a business where the risk of getting sued is greater than with other professions. Without adequate asset protection planning, a lawsuit or other unfortunate event – whether caused by you or not – could drain you of all of your personal assets, leaving you and your family penniless. Let’s take a quick look at a few ways to protect your assets and what you could do if you require asset protection planning in the Sooner State.

Asset Protection Planning Made Easy

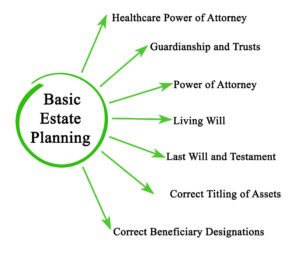

Asset protection planning is the use of legally permissible strategies to shield you from certain types of risks or liabilities. As the name suggests, asset protection planning means taking steps to protect your assets in advance of something bad happening. Certain assets that you own are already protected and you might not even know it, while other assets might need to be retitled or relocated to become protected. Some strategies are simple, but more often than not, proper planning requires sophisticated techniques such as the use of trusts or certain business structures including LLCs.

Individual Retirem ent Accounts

ent Accounts

The assets that you maintain in an individual retirement account (traditional IRA, Roth IRA) or other federally tax-exempt account is protected from creditors in Oklahoma. This is a level of asset protection that Oklahoma law provides; there is no federal law providing for creditor protection when it comes to IRAs. However, employer sponsored retirement accounts such as 401(k)s and some 403(b)s are protected from creditors under the Employee Retirement Income Securities Act (“ERISA”).

If you are sued, your bank account and investment account might become accessible to creditors. So, if you are in a position to stow away money for retirement in an individual retirement account or employer plan, one possible solution is for you to contribute your funds to those plans rather than keep the funds in certain taxable accounts or other non-retirement accounts that are titled in your name.

Joint Tenancy, Tenancy By The Entireties

As with most states, you could jointly own certain types of property which could provide a layer of asset protection. Joint tenancy is a common form of ownership available to just about anyone, while tenancy by the entireties (“TBE”) is only available to married couples. If you and your spouse jointly own property and one of you dies, the surviving spouse becomes the sole owner, and the property could become freed from the reach of the deceased spouse’s creditors. Specifically, any lien attached to the deceased spouse’s joint interest is extinguished as long as there has been no levy or execution before their death.

Assets In Trust For Asset Prote ction

ction

You could also obtain asset protection by placing your assets in an irrevocable trust. Basically, a trust is an arrangement in which a trustee is responsible for managing and distributing trust property for the trust’s beneficiaries. With a typical revocable living trust, you are the trustee and the beneficiary of the trust, and you can terminate the trust while you are alive. However, with a typical irrevocable trust, you are not the trustee or beneficiary of the trust, although it is possible for you to indirectly benefit from it.

Advanced asset protection in Oklahoma Estate Planning sometimes uses an irrevocable trust. An irrevocable asset protection trust allows you to obtain protection from creditors because the assets are no longer held or titled in your name. What if you are not concerned about lawsuits against you, but are instead concerned about the risks to your beneficiaries from their own creditors or judgment holders? Fortunately, an irrevocable trust can be set up so that your beneficiary could also receive the benefits of asset protection. In this context, a trustee can use discretion not to make distributions to a beneficiary who is subject of a lawsuit (including claims from an ex-spouse) or who has substance abuse problems or other legal risks. Further, spendthrift provisions could prevent a beneficiary from permitting a creditor to access their share.

Note that child support obligations are often exempt from these protections – so you can’t place assets in an irrevocable trust and expect to avoid paying your child support.

Assets In A Limited Liability Company

A more advanced asset protection mechanism is to place your assets in a business which provides liability protection. For example, a limited liability company (“LLC”) is a business that could provide you with the liability protection that is normally afforded to a corporation (protection from personal liability) while also providing you with the tax benefits that you would expect in a partnership (pass-through taxation).

Notably, your LLC membership interests – which signify your ownership in the LLC – can’t be taken by a creditor to satisfy its claim against you in Oklahoma. In fact, your creditor only has the rights to the profits which you are entitled to in the LLC. This means that if someone prevails in a lawsuit against you and obtains a judgement, they cannot just take your home or whatever LLC assets you own. A charging order is the creditor’s only remedy.

Establishing multiple series within an LLC can provide for even broader protection against lawsuits. Suppose that you own multiple real estate properties where there is a risk of liability associated with each property. If you have all of your real estate properties held under one LLC, a lawsuit associated with one of them could place the other assets at risk. However, you could instead segregate that liability through using a series LLC, in which case the liability would only attach to the particular series which holds property that is subject of the lawsuit. Alternatively, you could establish multiple LLCs and place each of your assets in a separate LLC.

Asset Protection Attorneys in Tulsa

The Tulsa attorneys at Kania Law Office have extensive experience in implementing asset protection plans including probate and estate plans for our Oklahoma clients to protect them and their families against legal risks. Our attorneys will review your assets, risk exposure and goals. We are well versed on crafting asset protection strategies to fit your individual needs, taking into account all viable options. Asset Protection in Oklahoma Estate Planning doesn’t have to be difficult. For a free consultation, reach out to Kania Law Office today by calling (918) 743-2233 or contacting us online.

Tulsa's Local Lawyers

Are you looking for Tulsa attorneys who will fight aggressively for you? Our team of attorneys have the experience needed in Oklahoma law to secure the outcome you deserve.

Are you looking for Tulsa attorneys who will fight aggressively for you? Our team of attorneys have the experience needed in Oklahoma law to secure the outcome you deserve.

Call us today for a free consultation 918-743-2233 or contact us online.