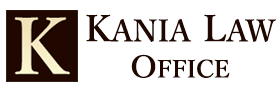

Chapter 7 bankruptcy is one of several types of bankruptcy available in Oklahoma. When financial stress becomes too much to handle, bankruptcy may provide a way forward. Chapter 7 bankruptcy, sometimes called a “fresh start” or “liquidation” bankruptcy, is one of the most common options. But how do you know if this is the right option for you? What Is…

How Do I Know if Chapter 7 Bankruptcy is Right for Me?