In Oklahoma you can name a minor as a beneficiary of your will or insurance policy. In estate planning, people may want to give money or valuable property to a minor child, whether their own child or a grandchild or a special niece or nephew. They leave this money either in a will or as the beneficiary of an insurance policy. Many people wonder, as they are preparing their estate plan, “Is it okay to name a minor a beneficiary of my estate?” The answer is that you are allowed to name a minor as a beneficiary of your estate in Oklahoma. This includes naming them as the beneficiary of an insurance policy. However, there are a few important considerations to keep in mind.

How To Distribute Assets To A Minor

Oklahoma laws do not allow a person who isn’t yet an adult, that is, someone under 18, to legally own property or assets of value. The law requires that a guardian hold and manage money for the child. A financial institution will require that the guardian have the legal power to hold the money for the benefit of the child, called Letters of Guardianship. Generally, the parents of a minor child are made the guardians of the money.

If a grandparent leaves assets for their grandchild in their will, the child’s parents must go through a court procedure to get the property officially transferred to them as guardian for the child. While the children are minors the parents can only use the money for the benefit of the children. In many circumstances the parents or guardian of the money will have to get court approval before any of the money is spent on the children. This means that before the parent uses the childs money for trips or other things the court must approve the expense.

Once The Child Reaches The Age Of Majority

When the child turns 18, the child is then an adult and is allowed to take full possession of the property, but questions remain as to whether they will use the money wisely when they are still just a teenager. If the will or other estate plan simply gifts money or valuable property to a minor as beneficiary of the estate, there are no limits on what the child will be allowed to do with the money when they become an adult.

Some kids may have the required level of responsibility to handle a large sum of money when they’re just out of high school, but many new adults who have just turned 18 are likely to behave like kids–meaning they may squander the money on things they want without thought for using the money wisely to help them establish their future. It is also important to keep in mind that there may be tax implications to leaving assets to a minor, particularly if the amount is substantial.

Establishing A Trust For a Minor Child

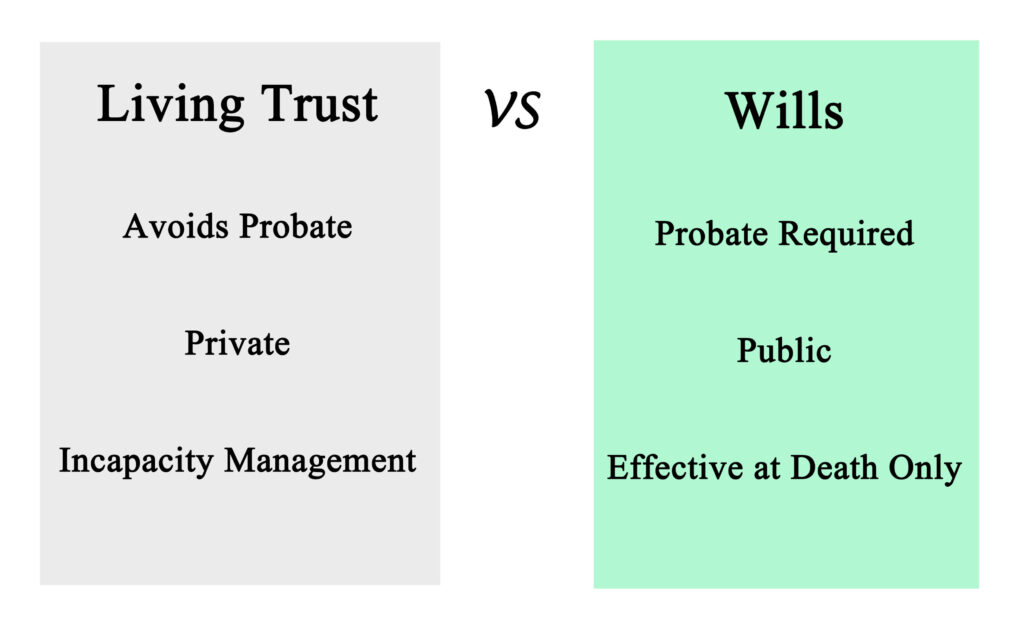

One option that may benefit the child and everyone involved is to establish a trust to hold the assets for their benefit. This method of distributing assets to a minor will simplify the transfer process and ensure that the assets are managed responsibly and are used for the benefit of the minor. A trust, including a special needs trust, can be set up with certain terms that will define how and when the child receives money from the account, including sums that can be set aside for needs like higher education, marriage, or other crucial life events.

With a trust, the trustee who handles the funds and property left for the child can have specific guidance as to how to distribute funds and use the money for the benefit of the child without needing ongoing court supervision as with guardianship. This type of arrangement lets the person leaving assets to a child have more say in how the money will be distributed and the benefits the child will receive from the funds.

Other Interesting Probate and Estate Planning Articles From Our Lawyers Blog

Tulsa Trust Attorneys Near You

Planning to distribute things of value after you die, like money, property, or investment accounts, involves careful planning. If you want to give money to a minor, there are even more issues to consider, because the child can’t legally take possession of any property until they become an adult. Questions regarding setting up a living trust or a will are important to your goals. The Tulsa Wills and Trust attorneys at Kania Law understand what is required to get the best result in your legal matter. Call 918-743-2233 or contact us online for more information and to schedule a free consultation.

Tulsa's Local Lawyers

Are you looking for Tulsa attorneys who will fight aggressively for you? Our team of attorneys have the experience needed in Oklahoma law to secure the outcome you deserve.

Are you looking for Tulsa attorneys who will fight aggressively for you? Our team of attorneys have the experience needed in Oklahoma law to secure the outcome you deserve.

Call us today for a free consultation 918-743-2233 or contact us online.