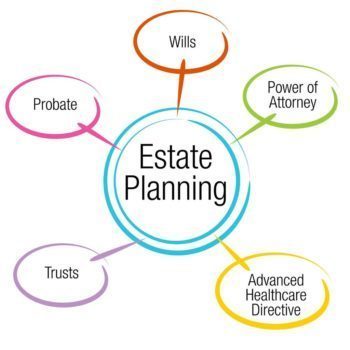

In Estate Planning people often turn to trusts as a way of passing assets to avoid probate. One of the many trusts available is the Irrevocable trust. Irrevocable Trusts are trusts that cannot be altered or ended once they are executed. Unlike revocable trust, they don’t allow for modification and termination if the trust creator has to make changes. Although an irrevocable trust can allow for minor changes concerning beneficiaries and trustees, usually the trusts are final and are not modifiable once the trust has been formally put in to place. Irrevocable trusts are predominately used for asset protection and estate planning, but those who use this type of trust must know precisely what is involved in creating one.

Irrevocable Trusts as Asset Protection

There are many benefits of an irrevocable trust in Oklahoma. One of the key advantages of an irrevocable trust is the ability to protect your assets. When you put your assets in an irrevocable trust, you do not own them anymore. Therefore, creditors cannot obtain a judgment against these assets because of this change in ownership. One issue to be concerned with is the timing in creating the trust. If the assets are transferred to the trust shortly before a lawsuit is filed the creditor may try to pierce the trust itself. The same thing exists for those who transfer assets into the Trust shortly before a bankruptcy is filed. The key to fully asset protecting your assets is to create the irrevocable trust well in advance of prospective creditor problems.

Taxes and Irrevocable Trusts

Another benefit of irrevocable trusts is the potential to avoid or reduce estate taxes. Because the assets in an irrevocable trust are no longer part of your estate, they cannot be taxed as part of your estate. Additionally, you may be able to retain some control over your assets when you establish an irrevocable trust. For instance, a grantor of an irrevocable trust preserves the “power of appointment” to designate beneficiaries who will benefit from the trust. This right is may be exercised after the trust is created.

Oklahoma Estate Planning Attorneys

Our Oklahoma Probate Lawyers understand that choosing what to do with your assets can be a difficult decision. Every estate is unique and there is no one-size-fits-all solution. Whether revocable or irrevocable, trusts have their limitations and advantages. Our legal team can guide you through your options in the planning of your estate. Call us today for a free consultation regarding your estate.

Tulsa's Local Lawyers

Are you looking for Tulsa attorneys who will fight aggressively for you? Our team of attorneys have the experience needed in Oklahoma law to secure the outcome you deserve.

Are you looking for Tulsa attorneys who will fight aggressively for you? Our team of attorneys have the experience needed in Oklahoma law to secure the outcome you deserve.

Call us today for a free consultation 918-743-2233 or contact us online.