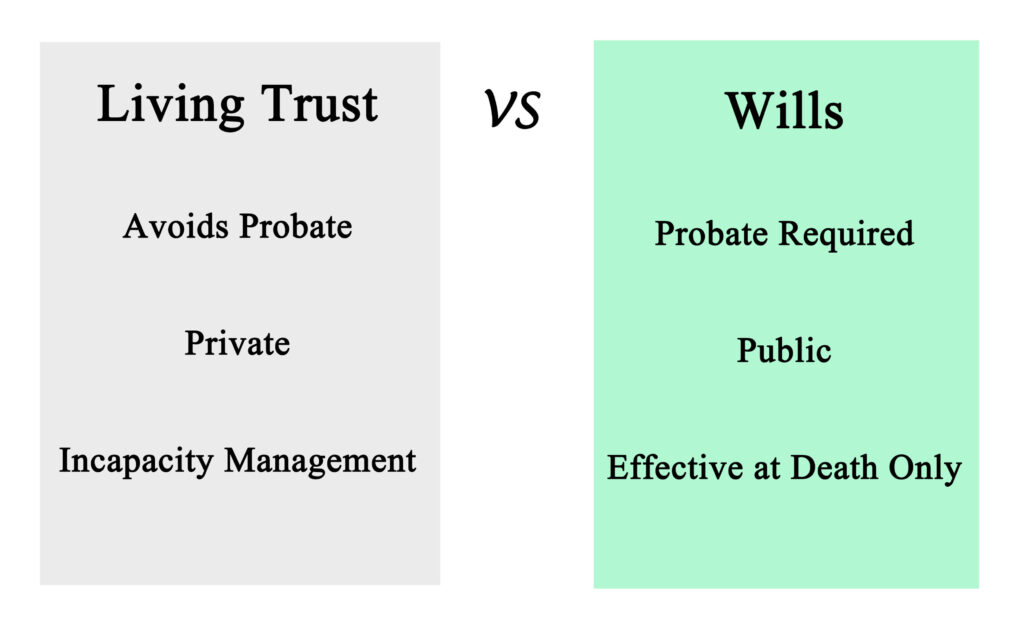

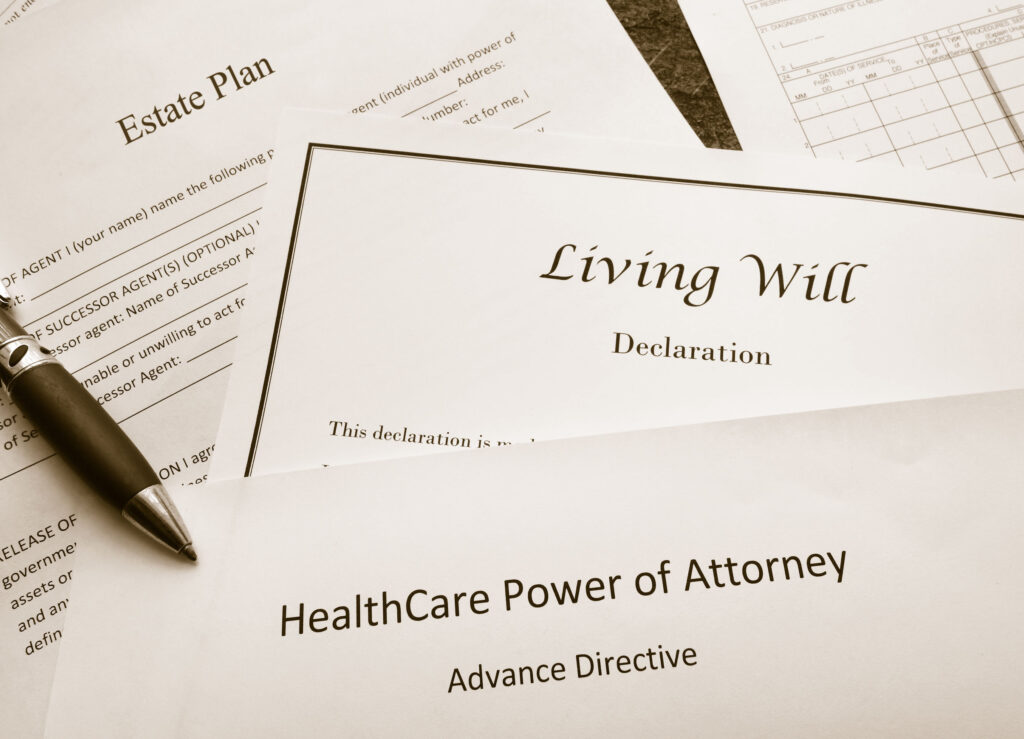

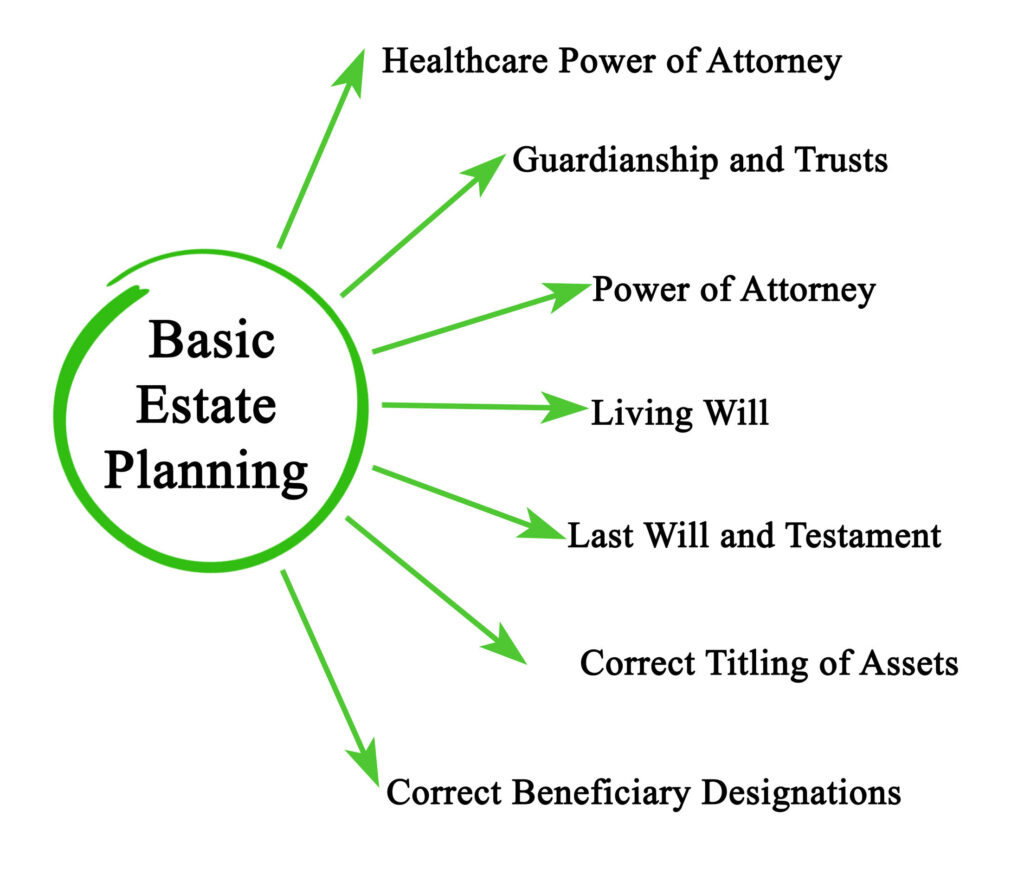

Creating a trust in Oklahoma isn’t as hard as many people think. When developing your estate plan, you have the option to incorporate trusts as part of your strategy. Trusts can serve as valuable tools to ensure your assets are distributed according to your wishes, while potentially avoiding the probate process. Understanding the process of creating a trust and the…

Creating a Trust in Your Oklahoma Estate Plan