If you are headed for bankruptcy there are certain clues along the way. Deciding whether to file for bankruptcy is a serious matter that requires a lot of thought. If you’re considering this step, consider whether the benefits of bankruptcy will outweigh the negative impacts that filing may have. It is also important to take an objective look at your financial situation before deciding to start the bankruptcy filing process. Below are a few indications that may mean that filing for bankruptcy may be in your best interests.

You Have Maxed Out Your Credit Cards

A single-maxed credit card may not signify overwhelming debt, but having multiple credit cards at or near their limit may indicate a financial struggle. If your credit cards are maxed, and you are no longer being approved for new lines of credit, you may be headed for bankruptcy. Additionally, if you are using your credit cards to pay for necessities and are unable to make minimum monthly payments, this may also be an indicator that you need debt management assistance and some financial relief.

You Are Missing Payment Installations

A huge red flag that you may be headed for bankruptcy is an inability to pay debt installments, whether monthly or otherwise. If you cannot pay your rent, mortgage, insurance, car loan, or other necessary payments, it might be time to seriously consider filing for bankruptcy. This is especially true if you’re struggling with more than one significant obligation.

You Have Experienced A Major Hardship

Unfortunately, many people struggle with significant debt due to a major, unexpected hardship. An example of a hardship may be an accident that requires significant medical attention or intervention. Such an accident could put you out of a job, and an insurance policy may not cover all necessary medical expenses. Sometimes, filing for bankruptcy is the only viable way to manage a challenging, unexpected hardship.

Debt Collectors Are Calling

Receiving phone calls and numerous letters regarding overdue debt is a likely sign that you may be headed for bankruptcy. Letters or calls threatening action typically begin when debt is overdue by over a month. Inability to pay these debts while living check-to-check may mean that a bankruptcy filing is necessary to pay these creditors.

You’re Ineligible For A Debt Management Plan

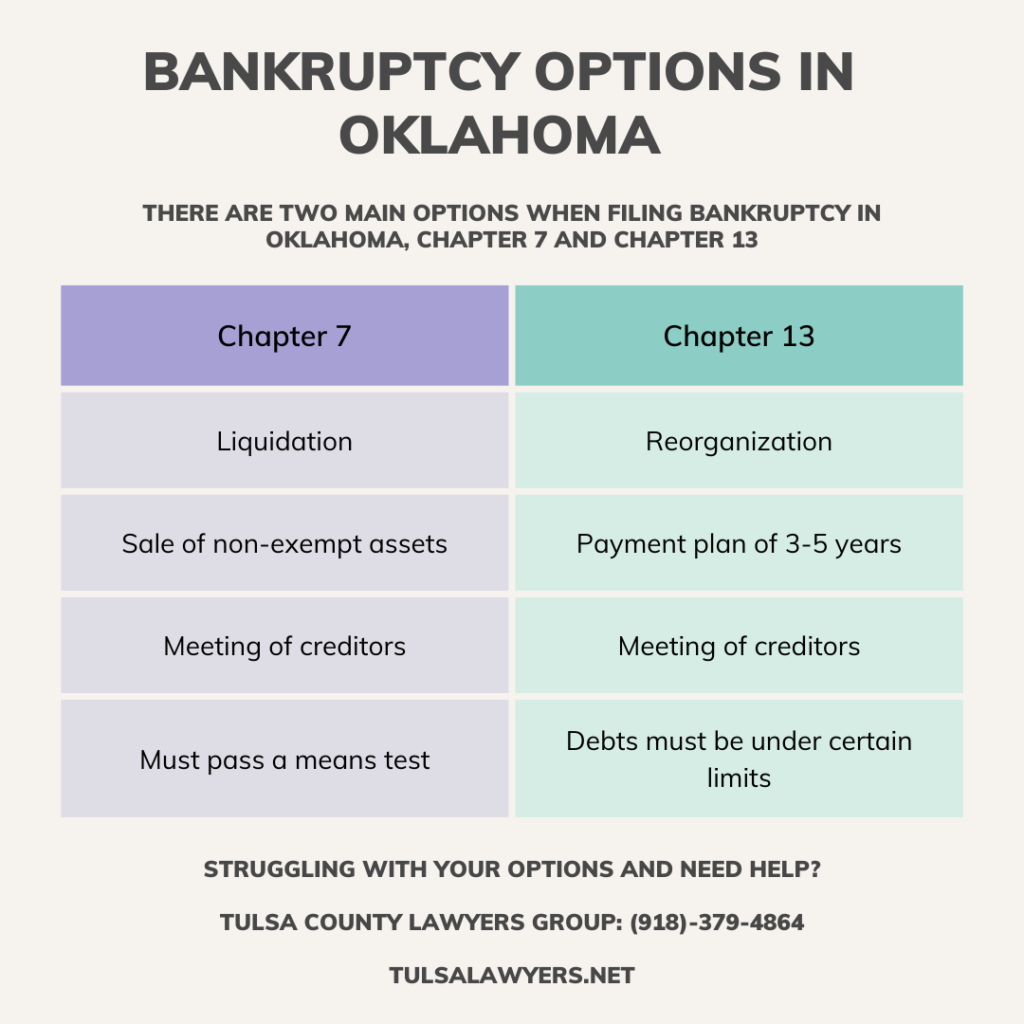

Debt management plans are sometimes helpful. This might include individuals who want to lower interest rates, reduce overall payments. But its important to realize they are not always successful. A credit or debt management counselor may reject you as ineligible for this resource if you do not make enough income, however. This is a clear sign that you may need to file for either a chapter 7 or chapter 13 bankruptcy to get back on track.

You Are Utilizing Loans With High Interest

Being without money for necessities often leaves individuals susceptible to taking out loans with excessive interest rates. This situation can lead to more and more debt incurred over time. This is especially the case if the loans are used for necessities. Taking out multiple high-interest loans may be a significant sign that you are headed toward needing to file for bankruptcy.

You Are Struggling With Debt Generally

If you are experiencing more than one of the indicators set out above, these signs are rather telling. Although experiencing one of the indicators may indicate modest financial difficulties, experiencing a few or several of the indicators above is a sign that you may need to think about filing for bankruptcy. If this is you there are common types of bankruptcy that accomplish the goal of being debt free.

Check Out Our Oklahoma Bankruptcy Blog For Helpful Information

Oklahoma Bankruptcy Attorneys Near You

If you are experiencing one or more of the signs above, please reach out to Kania Law Office. We have extensive experience representing bankruptcy clients. We do this by assisting individuals in Chapter 7 and Chapter 13 bankruptcy cases, and we can help you too. If you are worried or stressed about overdue debt, please give us a call at 918-743-2233 or visit our website. We offer free telephone consultations. We look forward to hearing from you.

Tulsa's Local Bankruptcy Lawyers

Are you looking for Tulsa attorneys who will fight aggressively for you? Our team of bankruptcy attorneys have the experience needed in Oklahoma law to secure the outcome you deserve.

Are you looking for Tulsa attorneys who will fight aggressively for you? Our team of bankruptcy attorneys have the experience needed in Oklahoma law to secure the outcome you deserve.

Call us today for a free consultation 918-743-2233 or contact us online.