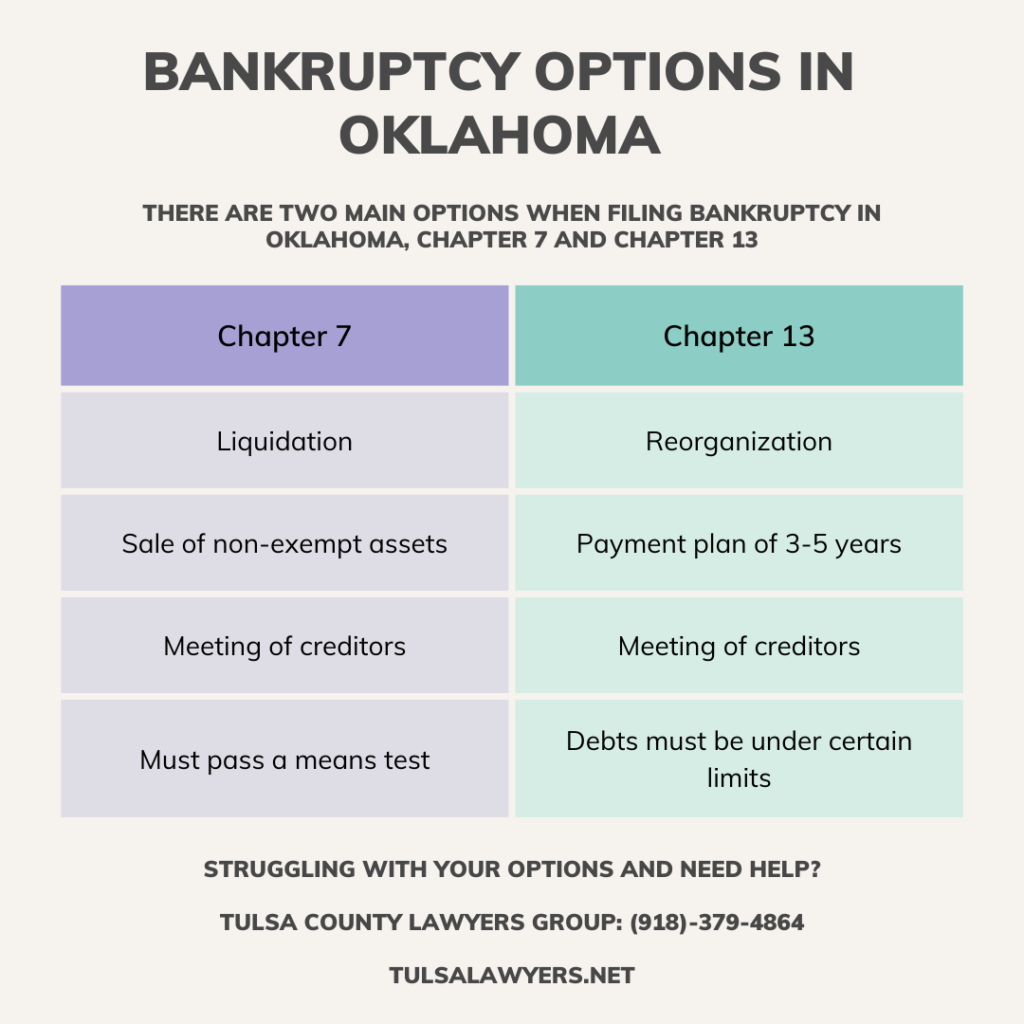

Keeping some credit cards in a Chapter 7 bankruptcy is a common interest when considering bankruptcy. Filing for Chapter 7 bankruptcy offers individuals a chance to discharge most of their unsecured debts and gain a fresh start. However, it’s important to understand how this affects your credit cards and whether you can keep any of them. Typically, filing for Chapter…

Can I Keep Some of My Credit Cards in a Chapter 7 Bankruptcy?